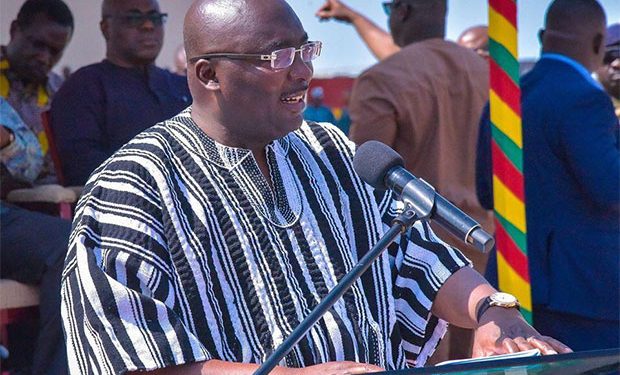

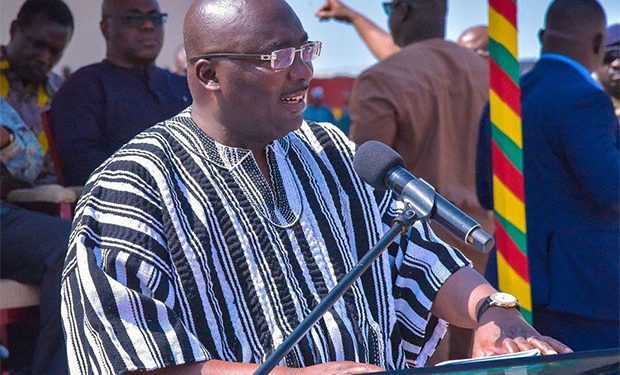

I’ll introduce a flat tax regime if elected president – Bawumia

Flagbearer of the New Patriotic Party, Dr Mahamudu Bawumia says his administration will “introduce a very simple, citizen and business-friendly flat tax regime” if he is elected president.

Addressing the nation on his vision if elected president at the University of Professional Studies, Accra, on Wednesday, Dr Bawumia said his administration would introduce a flat tax of a percentage of income for individuals and Small and Medium Enterprises SMEs (which constitute 98% of all businesses in Ghana) with appropriate exemption thresholds set to protect the poor.

“With the new tax regime, the tax return should be able to be completed in minutes! We will also simplify our complicated corporate tax system and VAT regime,” he added.

Dr Bawumia also stated categorically that he would abolish the tax on electronic financial transactions, popularly known as e-levy if elected President of Ghana.

The controversial tax was introduced in 2022, and before the introduction, Vice President Bawumia had declared his opposition to levies on electronic financial transactions in an interview.

Dr Bawumia minced no words in declaring his opposition to taxes on electronic financial transactions, declaring that he will abolish e-levy as President.

Dr Bawumia added that his bid for a digital and cashless Ghana will be significantly boosted if e-levy is abolished.

“To move towards a cashless economy, however, we have to encourage the population to use electronic channels of payment. To accomplish this, there will be no taxes on digital payments under my administration. The e-levy will, therefore, be abolished,” he declared.

Dr Bawumia also announced that as part of a new tax regime by his government, he will also abolish the emission tax, tax on betting as well as the proposed 15% VAT on electricity tariffs, if it is in existence by January 2025.