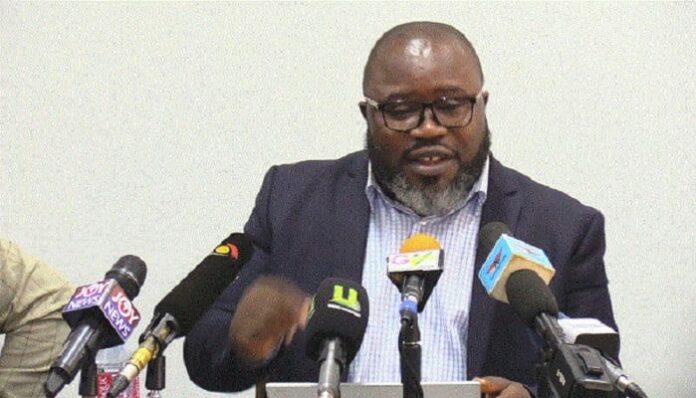

How much did NDC pay Bawumia to think of scrapping e-levy – Kofi Asare mocks NPP footsoldiers

Executive Director of the Africa Education Watch (Eduwatch), Mr Kofi Asare has said that when civil society and independent-minded citizens called for the withdrawal of e-levy, footsoldiers of the New Patriotic Party (NPP) were deployed to insult them.

However, their flagbearer, Vice President Dr Mahamudu Bawumia has promised to abolish it.

He recounted that some of the party supporters even accused the CSOs of being paid by the National Democratic Congress (NDC) to oppose the e-levy.

Going by their logic he asked, how much the NDC paid Dr Bawumia to think of scrapping the e-levy?

“When civil society and independent-minded citizens called for the withdrawal of e-levy, party footsoldiers were deployed to insult us. They said we were paid by the NDC to oppose e-levy because, the NDC was afraid e-levy would turn Ghana into America. How much did the NDC pay DMB to think of scrapping the e-levy?” He wrote on Facebook.

Dr Bawumia had stated categorically that he would abolish the tax on electronic financial transactions, e-levy, if elected President of Ghana.

The controversial tax was introduced in 2022, and prior to the introduction, Vice President Bawumia had declared his opposition to levies on electronic financial transaction in an interview.

Delivering his first major address to the nation after his election as NPP flagbearer, during which he gave broad policy outlines of a Bawumia Presidency, Dr. Bawumia minced no words in declaring his opposition to taxes on electronic financial transactions, declaring that he will abolish e-levy as President.

Dr. Bawumia also announced that as part of a new tax regime by his government, he will also abolish the emission tax, tax on betting as well as the proposed 15% VAT on electricity tariffs, if it is in existence by January 2025.

He also announced that his government would introduce what he described as a friendly, flat tax regime for Ghana, which will boost individuals and businesses, particularly small and medium-scale enterprises (SMEs).

“My administration will introduce a very simple, citizen and business-friendly flat tax regime. A flat tax of a percentage of income for individuals and SMEs, which constitute 98% of all businesses in Ghana, with appropriate exemption thresholds set to protect the poor,” Dr. Bawumia indicated.